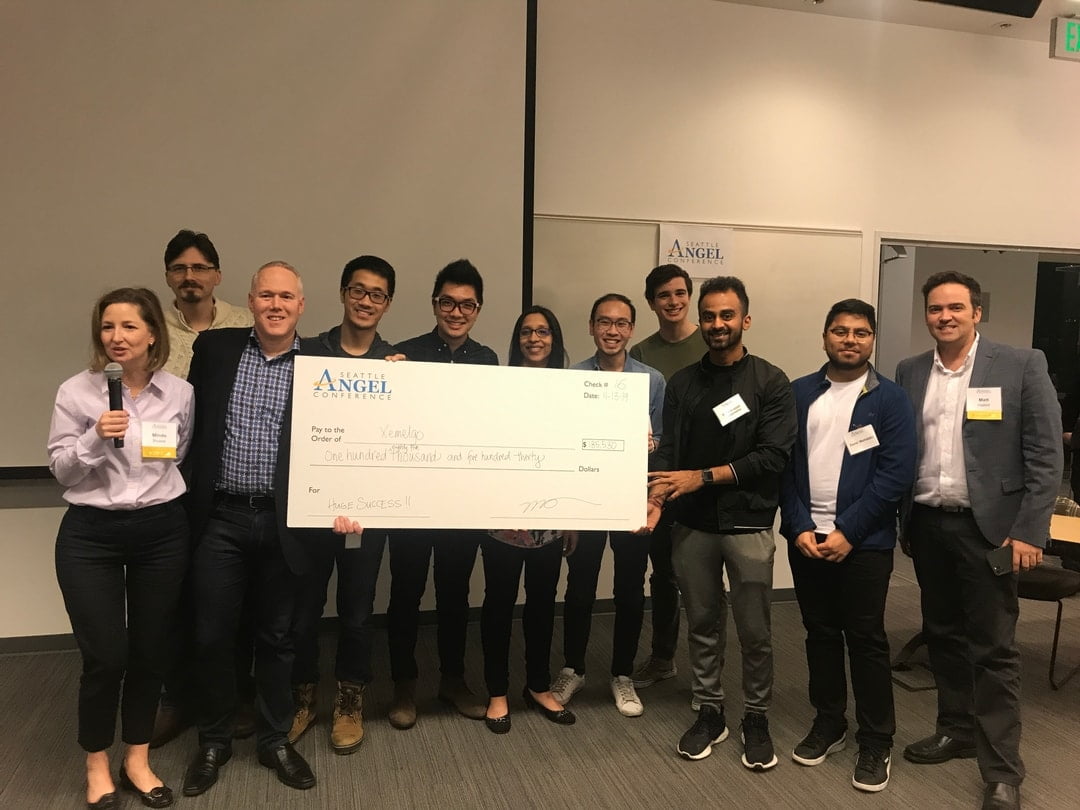

The Angel Conference program is a structured investment. In the beginning, we start with a series of workshops to attract, teach and grow new investors and startups. It then goes into an "American Idol" style selection phase with startup pitches, company visits, and Q&A from investors. We aim for 50+ applying companies with 30-40 investors. We try to have a balance of 50/50 between new investors and previous investors. Each investor contributes $6000 to create a fund between $150K and $200K. After narrowing the companies down to six finalists, the investors split up into due diligence teams to dig deeper into the companies. Finally, we host a big demo-day event where the finalists present and the investors select the winner who will receive the investment. Some time the investors choose to do a side car on one or several other companies.

The Seattle Angel Conference runs twice a year. The Spring conference has an application deadline in February and the final event is in May. The Fall conference has an application deadline of August and the final event is in November.

An Angel Investor is someone who invests their own money into an un-registered startup. This is allowed through an SEC exemption for "Accredited Investors" in Reg D 506(b). To be accredited, you need to have an annual income of $200K or $300K with your spouse, or you need to have a net worth of more than $1M, not including your primary residence.

To be a "good" Angel Investor, you need to understand the structure of companies, how the team works together, how the financials are being managed and the risks the business is facing. You should also understand how a portfolio of 20+ companies can be created to make up for the risk associated with any individual early staged company.

A good place to start is to read the book by David Rose called "Angel Investing"

If you are not "Accredited" (yet), then you might look at Equity Crowdfunding as a pathway to getting started in angel investing.

The Angel Conference looks for companies that are early, often pre-seed and seed. However, we want them to be more than just an idea. We want to see evidence that the team can work together on a business and that the market cares about the result. Traction often looks like growing revenue. We expect applicants to be growth companies that have a pathway to making a significant change in valuation and have a pathway to an exit.

The Seattle Angel Conference has no sector bias and accepts companies from North America.

We are looking at early companies that have typically taken grants, and friends and family money and are seeking outside investment. We tend to invest in a convertible note. We will work with the founder to consider their other funding agreements.

Yes. Allowing the public to view the final event helps grow the investor and startup ecosystem in the greater Seattle area; Interested accredited investors get to learn more about the process and early staged companies get to see what it takes to become a fundable company.