Julie Interviews Angela Roberts from Conquer Experience about SAC Experience

Julie Interviews Angela Roberts from Conquer Experience about SAC Experience

The blog-series “Startup People of Seattle” introduces some of the key personas in the ecosystem to learn more about what they are doing, to share their thoughts and ideas, and to promote networking.

In our ninth interview, meet Josh Trujillo:

“The two things founders who I have talked to struggled with the most were hiring and sales.”

Josh recently moved from San Francisco to Seattle. He now is member success manager at Galvanize. Ahead of this interview, Josh talked to many entrepreneurs at Galvanize asking them what they struggle with most.

https://www.linkedin.com/in/josh-trujillo-076046100/

Mikaela Kiner interviews Xiao Wang of Boundless about starting his startup.

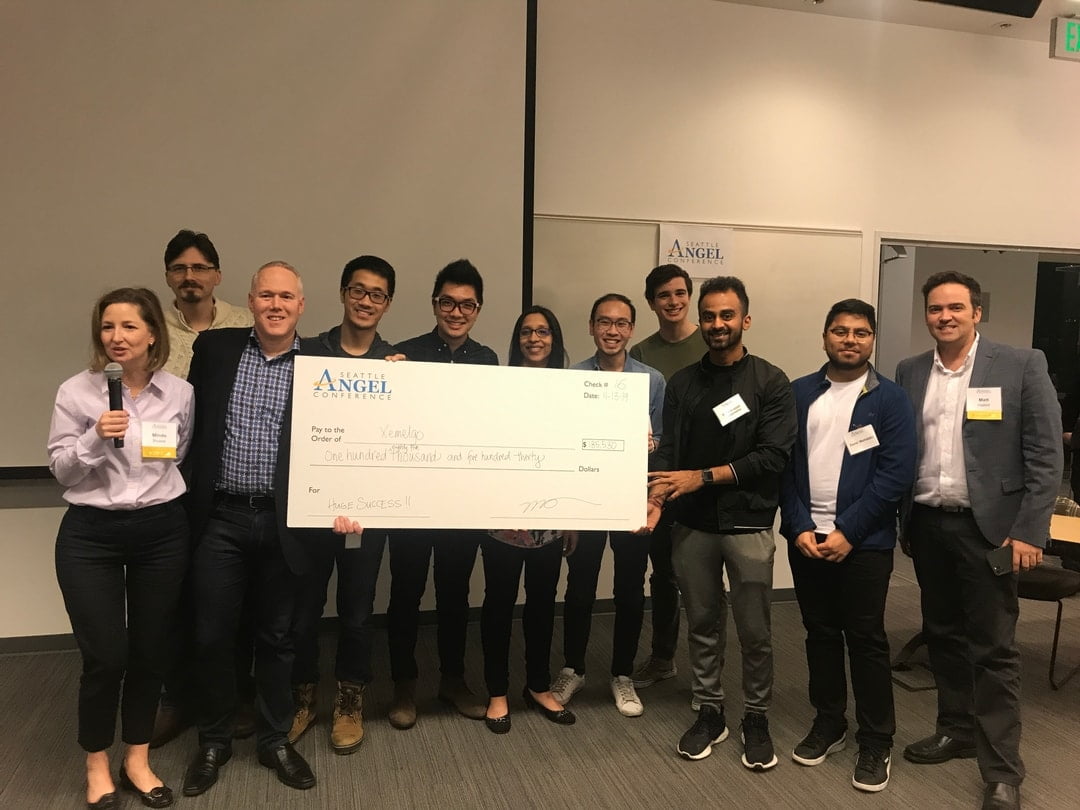

These are unsolicited testimonials from Angel Investors and Startups.